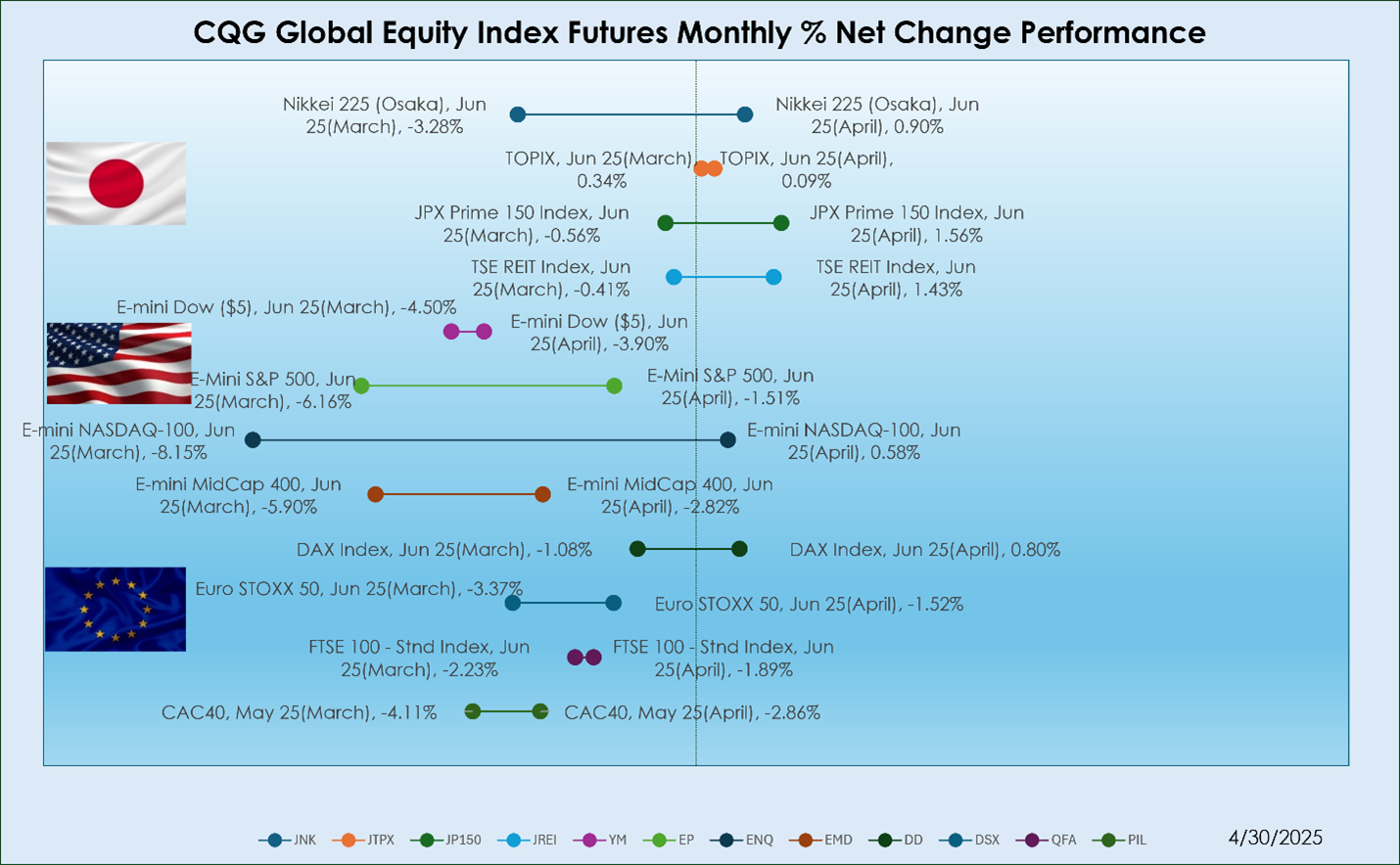

Japanese Market

In the Japanese equity futures market, JPX Prime 150 Index, Jun 25 emerged as the top performer in April, recording a gain of +1.56%. In comparison with the previous month, the TOPIX, Jun 25 led with a modest gain of +0.34%.

USA Market

The U.S. equity futures market experienced a significant downturn, with the E-mini NASDAQ-100, Jun 25 posting the strongest performance despite a modest gain of +0.58%. In contrast, March’s top performer, the E-mini Dow($5), Jun 25, despite a decline of -4.50%.

European Market

European markets also demonstrated varied results. The DAX Index, Jun 25 recorded the highest performance within the region, albeit with a slight increase of +0.80%. In comparison, where the same contract recorded a decrease of -1.08%.

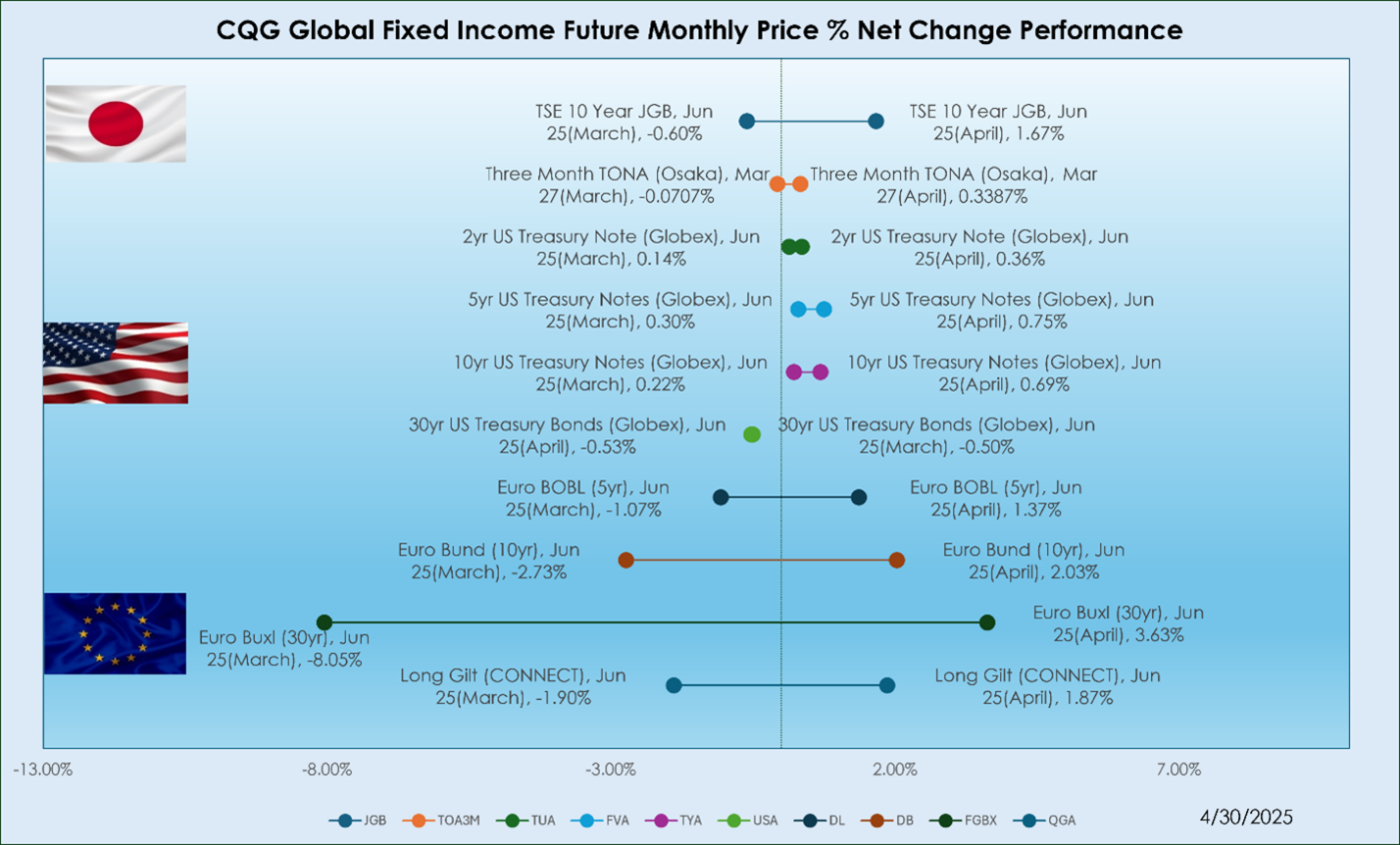

Japanese Market

In the Japanese fixed income futures market, TSE 10 Year JGB, Jun 25 contract emerged as the top performer, posting a gain by +1.67%. In comparison from March, Three-Month TONA (Osaka), Mar 27 contract posting a decline by -0.0707%.

USA Market

In the U.S. fixed income futures market, the 5yr US Treasury Notes (Globex), Jun 25 contract emerged as the best performer, posting a +0.75% gain. This marks a contrast to the previous month, where the same contract recorded an increase of +0.30%.

European Market

The European fixed income futures market showed a relatively stronger performance, with the Euro Buxl (30yr), Jun 25 contract leading with a +3.63% gain. In March, the Euro BOBL (5yr) Jun 25 contract was the strongest performer, despite having recorded a -1.07% decrease.

Note: For scaling purposes, the chart displays the current midweek net percentage change and the previous week’s net percentage change for fixed income products. If the percentage net change is positive then yields have fallen. If the percentage net change is negative then yields have risen.