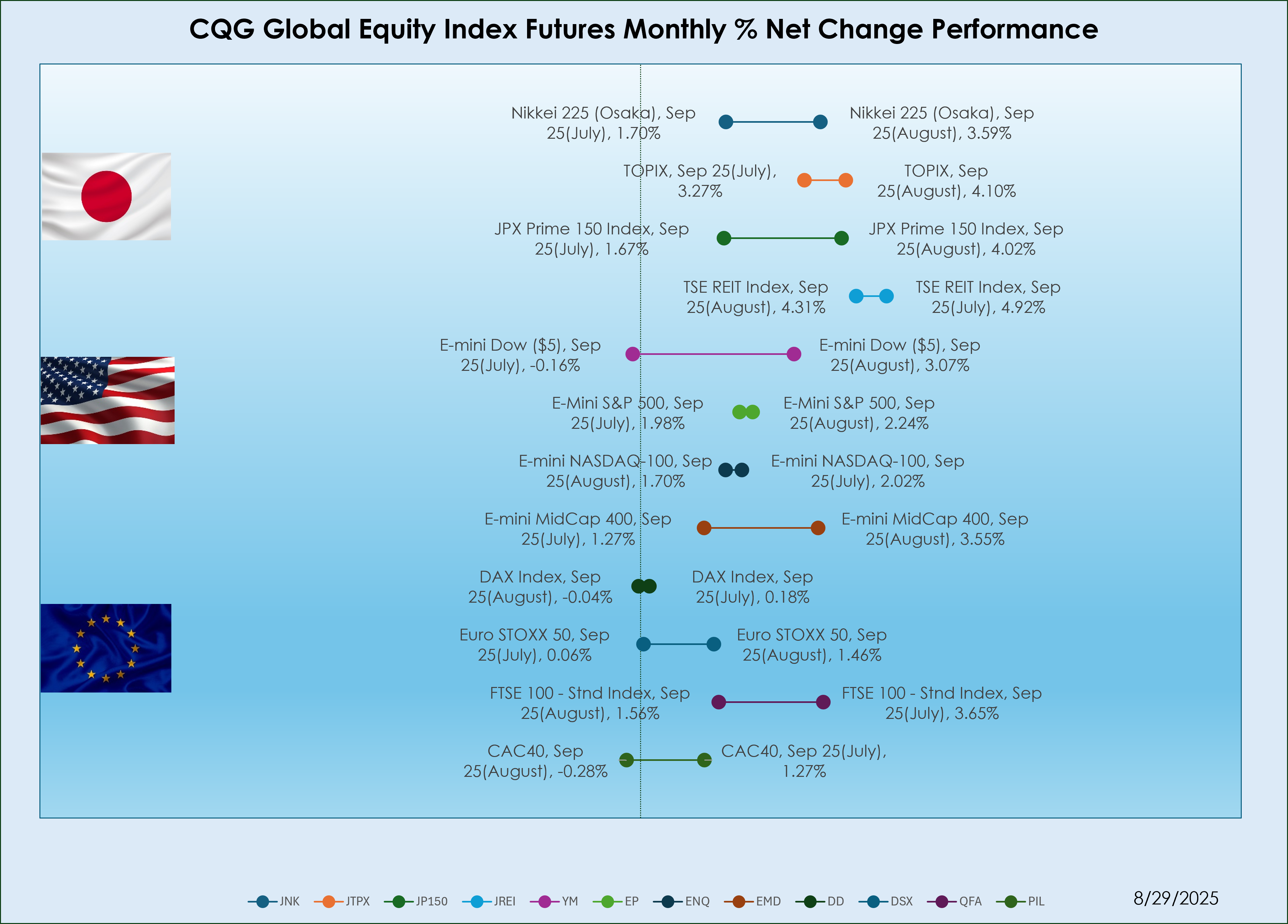

Japanese Market

In the Japanese equity futures market, the TSE REIT Index, Sep 25 contract posted the strongest gain in August, rising by +4.31%. This follows a solid performance in the previous month for the same contract, which saw a gain of +4.92%.

U.S. Market

In the U.S. equity futures market, the E-mini MidCap 400, Sep 25 led with an increase of +3.55%. For comparison, the leading contract in July was the E-mini NASDAQ-100, Sep 25, which recorded a gain of +2.02%.

European Market

In the European markets, the FTSE 100-Stnd Index, Sep 25, recorded the region's highest gain at +1.56%. The same contract also posted as leading contract in July recorded a more substantial gain of +3.65%.

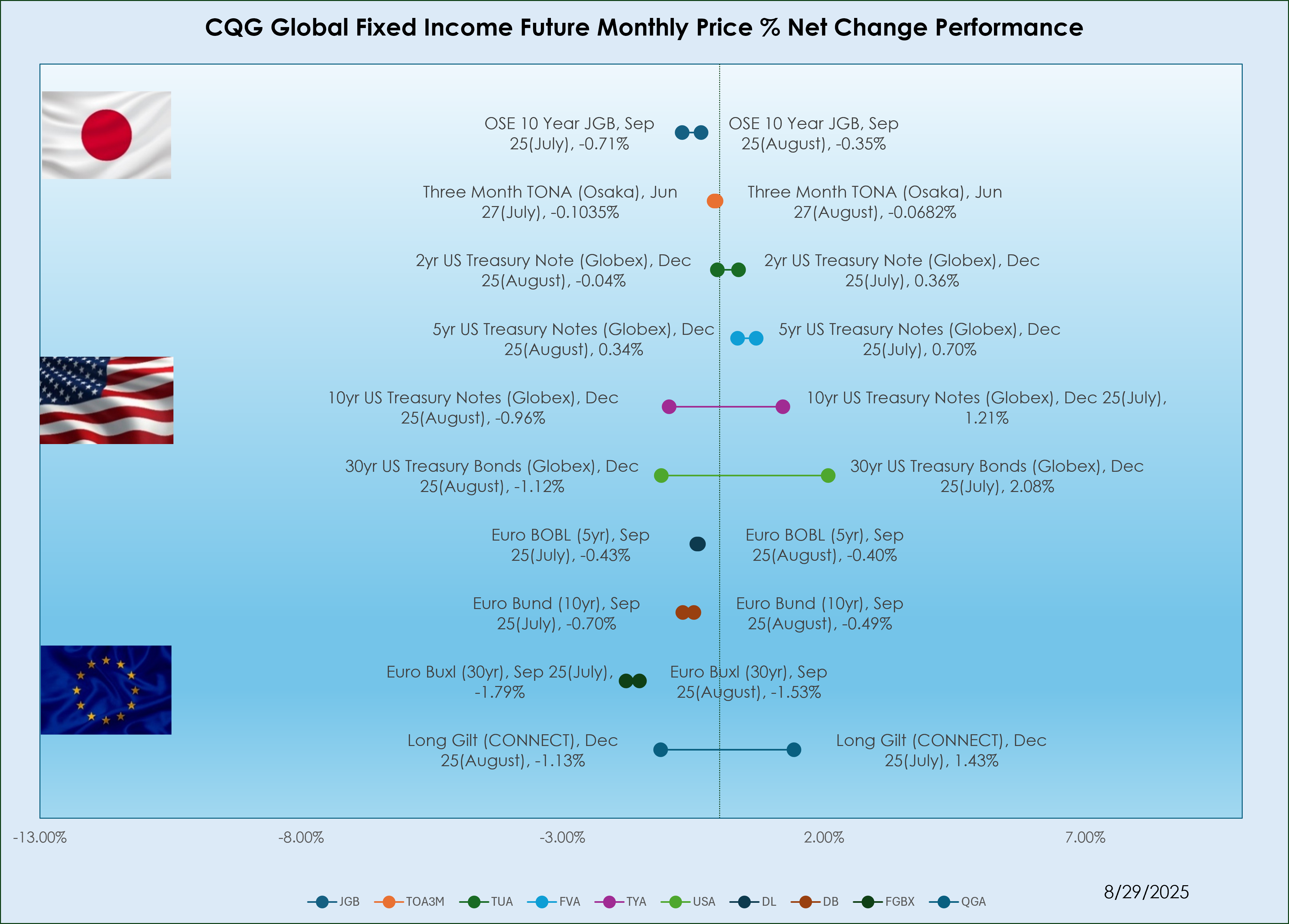

Japanese Market

In August, the Three-Month TONA (Osaka), Jun 27 contract led the market, declining by -0.0682%. This followed its performance in July, where the same contract also posted the most significant movement with a -0.1035% loss.

USA Market

The 5yr US Treasury Notes (Globex), Dec 25 contract posted the top gain of +0.34%. This contrasts with the previous month, where the 30yr US Treasury Bonds (Globex), Dec 25 contract had led the market with a larger increase of +2.08%.

European Market

The Euro BOBL (5yr), Sep 25, contract recorded a slight decline in the region at -0.40%. In July, the leading contract was the Long Gilt(CONNECT), Dec 25, which recorded a substantial increase of +1.43%.

Note: For scaling purposes, the chart displays the current midweek net percentage change and the previous week’s net percentage change for fixed income products. If the percentage net change is positive then yields have fallen. If the percentage net change is negative then yields have risen.