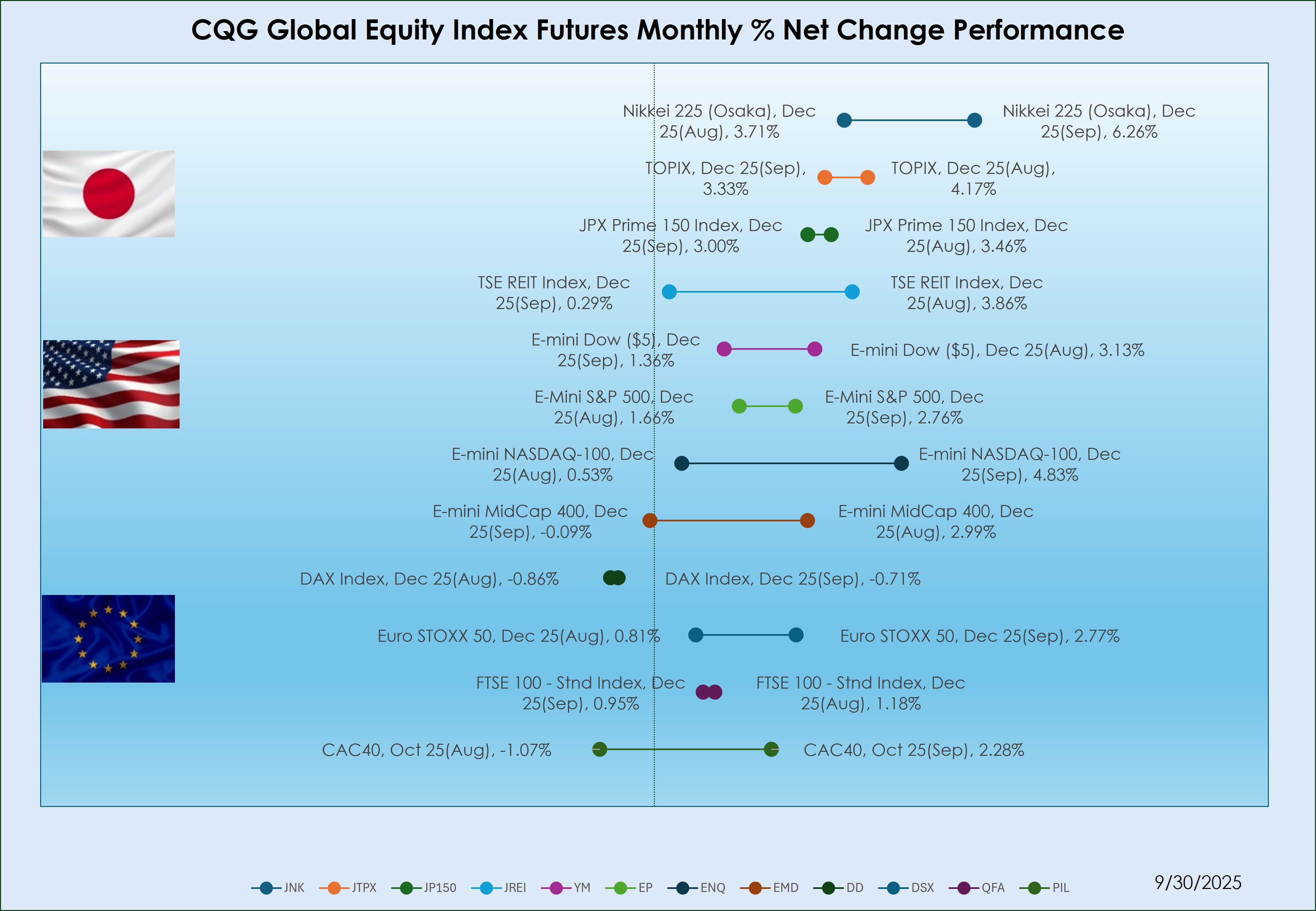

Japanese Market

In the Japanese equity futures market, the Nikkei 225 (Osaka), Dec 25 contract posted the strongest gain in September, rising by +6.26%. This follows a solid performance in the previous month for the TOPIX, Dec 25 contract, which also saw a gain of +4.17%.

USA Market

In the U.S. equity futures market, the E-mini NASDAQ-100, Dec 25 led the way with a significant increase of +4.83%. For comparison, the leading contract in August was the E-mini Dow($5), Dec 25, which recorded a gain of +3.13%.

European Market

In the European markets, the Euro STOXX 50, Dec 25 recorded the region's highest gain at +2.77%. The FTSE 100-Stnd Index, Dec 25 contract, which was the leading contract in August, also posted a substantial gain of +1.18%.

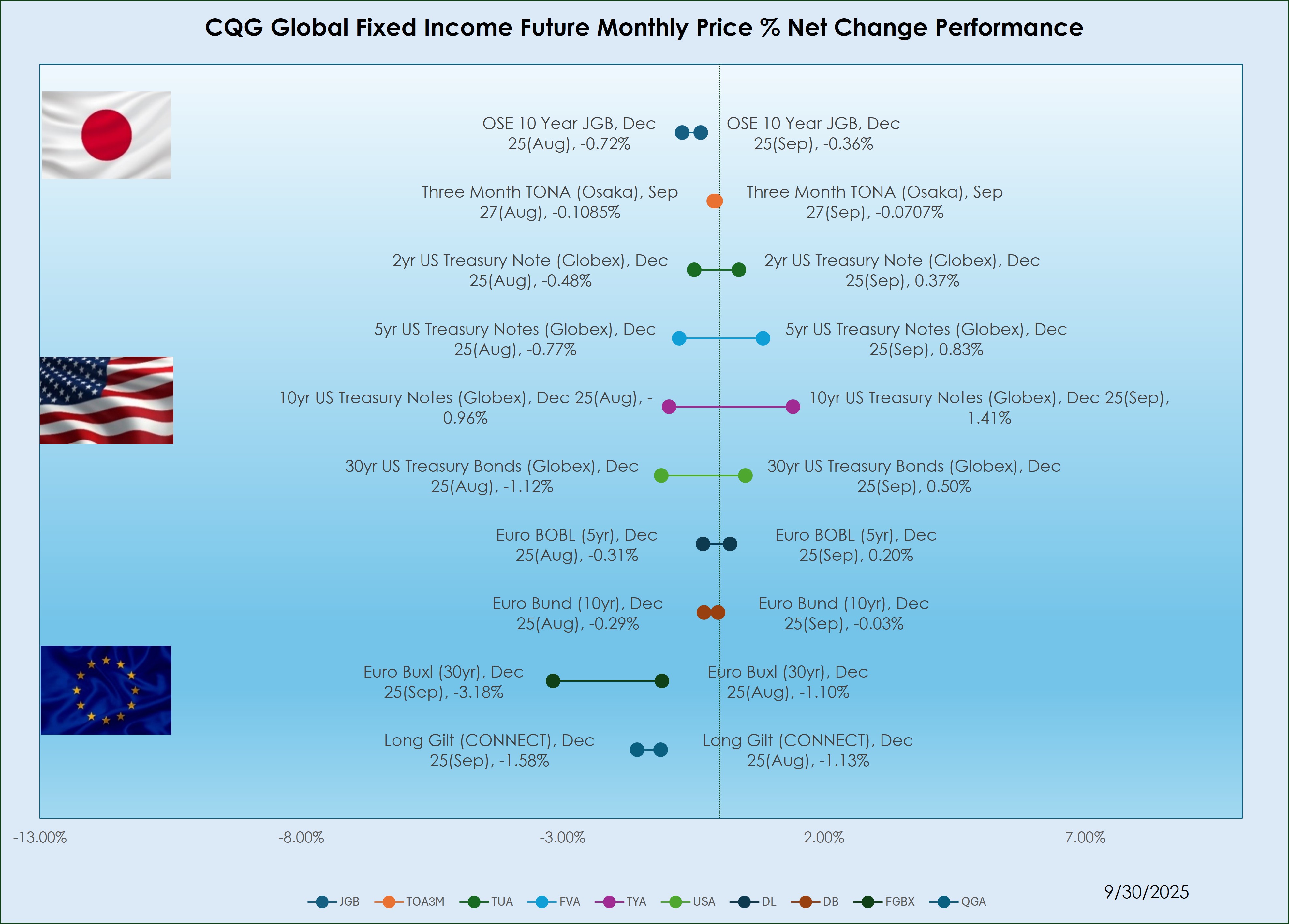

Japanese Market

In the Japanese interest rate market for September, the Three-Month TONA (Osaka), Sep 27 contract led the market by declining −0.0707%. This continued a trend from August, when the same contract also posted the most notable decrease with a −0.1085% loss.

USA Market

The 10yr US Treasury Notes (Globex), Dec 25 contract posted the strongest gain, rising by +1.41%. This contrasts with the previous month, where the 2yr US Treasury Bonds (Globex), Dec 25 contract led the market, but with a modest drop of −0.48%.

European Market

The Euro BOBL (5yr), Sep 25 contract recorded a minor rise, increasing by +0.20% in the region. In August, the leading contract was the Euro Bund (10yr), Dec 25, which recorded a moderate decrease of −0.29%.

Note: For scaling purposes, the chart displays the current midweek net percentage change and the previous week’s net percentage change for fixed income products. If the percentage net change is positive then yields have fallen. If the percentage net change is negative then yields have risen.