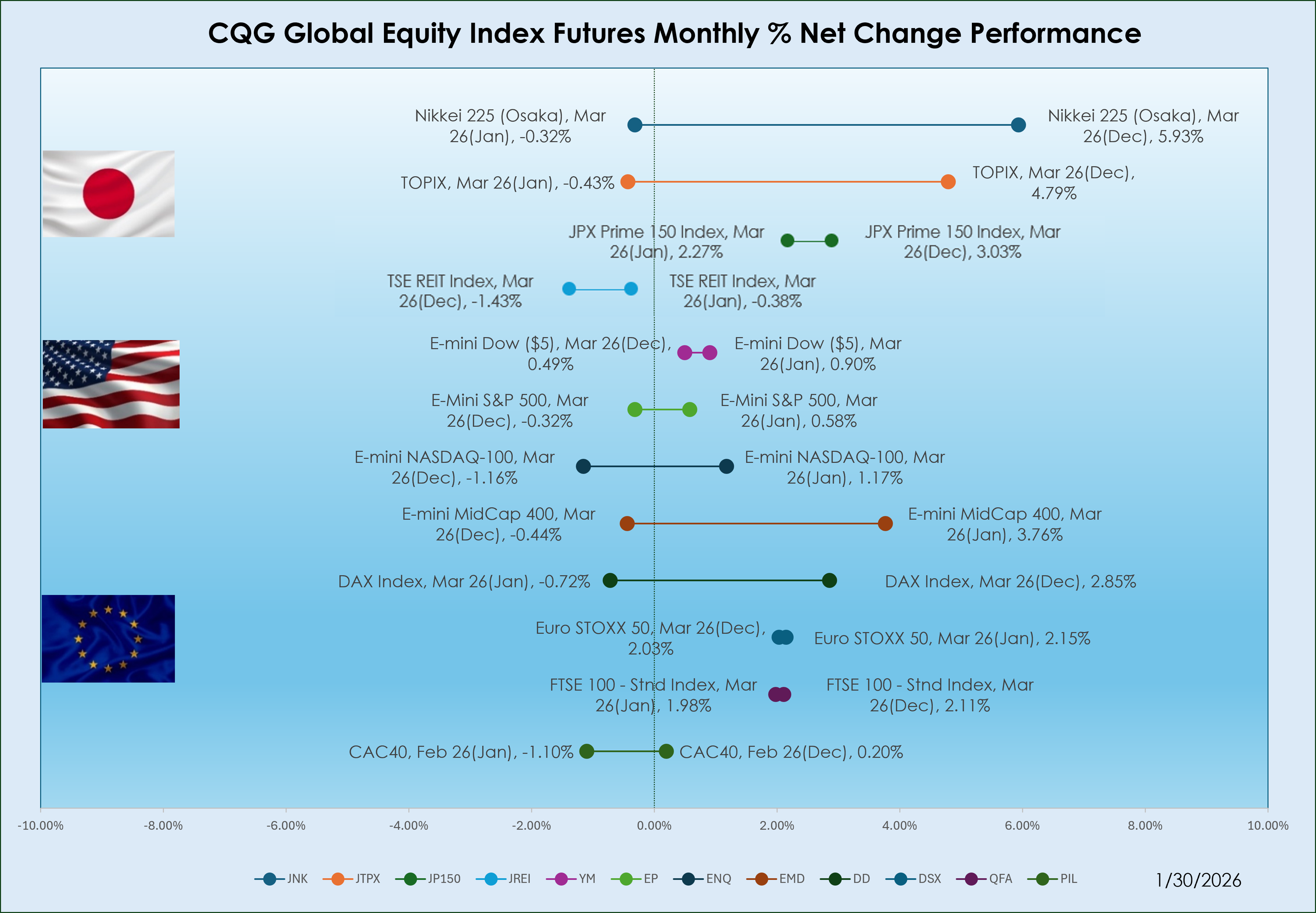

Japanese Market

In the Japanese equity futures market, the JPX Prime 150, Mar 26 contract led in January, with a gain by +2.27%. This follows a solid performance in the previous month for the Nikkei 225 (Osaka), Mar 26, which also saw a robust gain of +5.93%.

USA Market

In the U.S. equity futures market, the E-mini MidCap 400, Mar 26 led the way with a significant increase of +3.76% in January. For comparison, the E-mini Dow ($5), Mar 26 in December was recorded a gain of +0.49%.

European Market

In the European markets, the Euro STOXX 50, Mar 26 recorded an increase at +2.15% in January. The DAX index, Mar 26 contract, which was the leading contract in December, posted a gain of +2.85%.

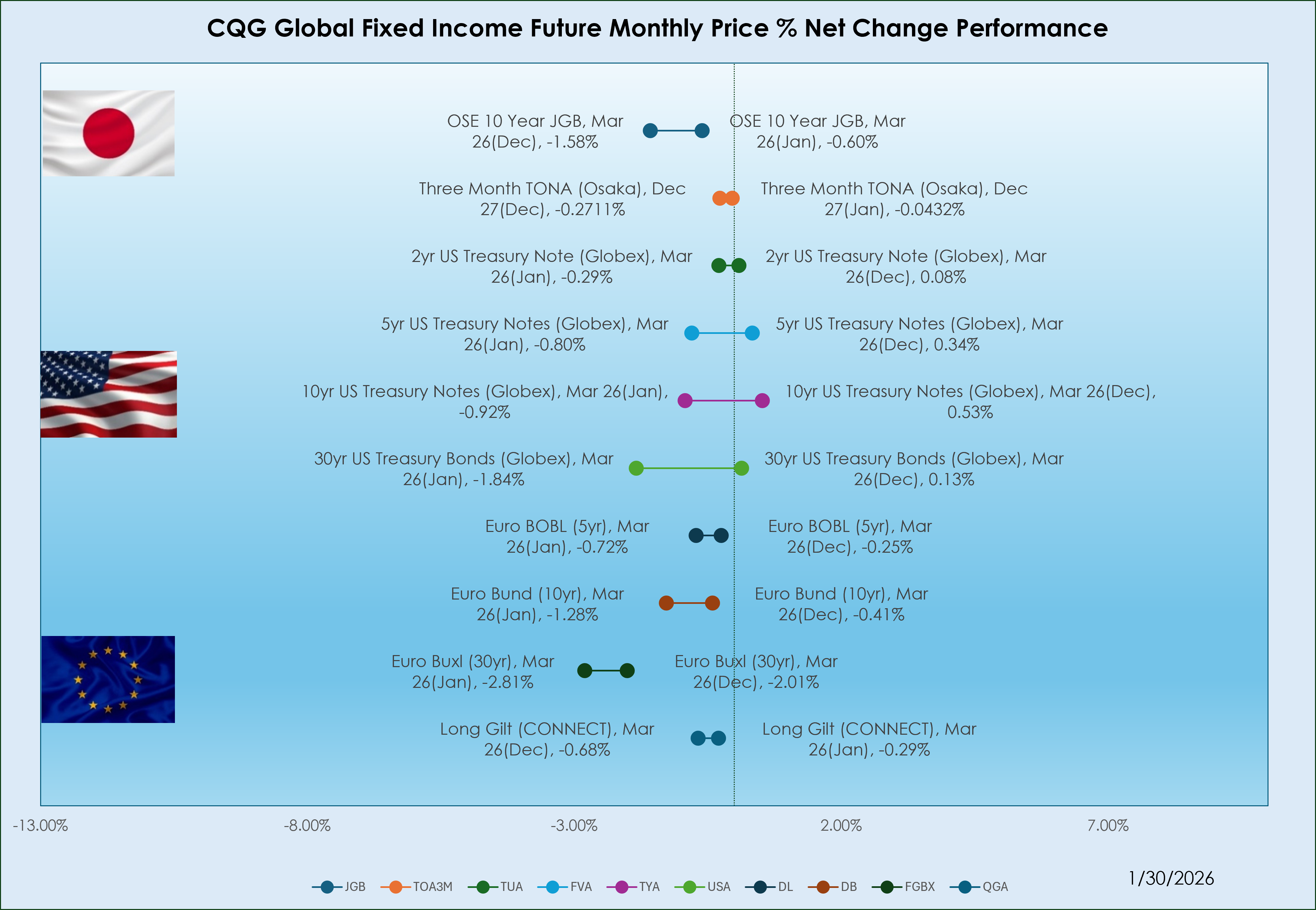

Japanese Market

In the Japanese interest rate market for January, the Three-Month TONA (Osaka), Dec 27 contract led the market by declining -0.0432%. This continued a trend from December, the same contract posted with a slight decrease of -0.2711%.

USA Market

The 2yr US Treasury Note (Globex), Mar 26 contract led the market by a slight drop of -0.29%. This contrasts with the previous month, where the 10yr US Treasury Notes (Globex), Mar 26 contract led the market, with a slight gain of +0.53%.

European Market

The Long Gilt (CONNECT), Mar 26 contract recorded a slight drop by -0.29% in the region. In December, the leading contract was the Euro BOBL (5yr), Mar 26 which recorded a slight decrease of -0.25%.

Note: For scaling purposes, the chart displays the current midweek net percentage change and the previous week’s net percentage change for fixed income products. If the percentage net change is positive then yields have fallen. If the percentage net change is negative then yields have risen.